Compensation Discussion and Analysis

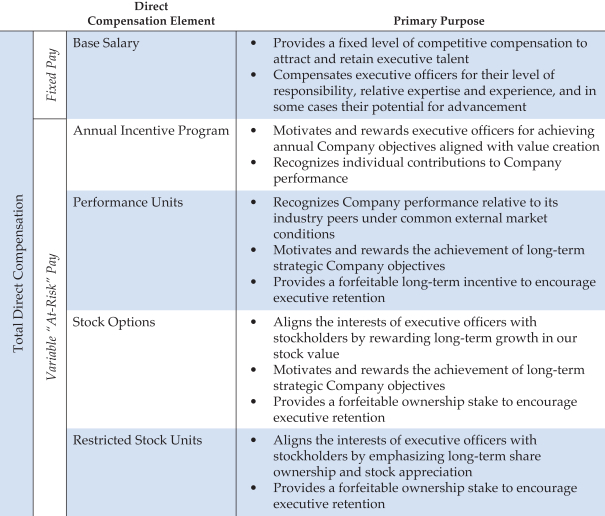

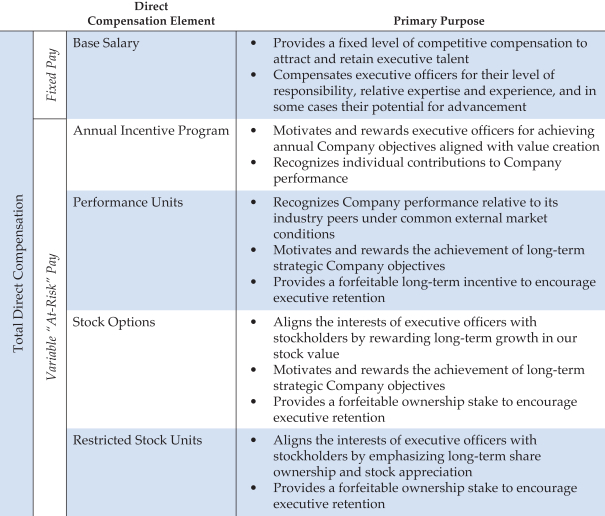

Direct Compensation Elements

The direct compensation elements are outlined in the table below. The indirect compensation elements are outlined in a table on page 51.

| | | | |

| | | 41

| |

Compensation Discussion and Analysis

ANALYSIS OF 2014 COMPENSATION ACTIONS

The following is a discussion of the specific actions taken by the Committee in 2014 related to each of our direct compensation elements. Each element is reviewed annually, as well as at the time of a promotion, other change in responsibilities, other significant corporate events or a material change in market conditions.

As discussed above, the Committee determined that the target total compensation opportunity for the NEOs should remain flat year-over-year and that no changes should be made to the current base salaries, target bonus opportunities, and target grant value of annual long-term incentive awards.

Base Salary

The table below reflects the base salaries for the NEOs that were approved by the Committee in 2014:

| | | | | | | | | | | | | | | |

Name | | Salary as of

January 1, 2014($) | | Salary as of

November 9, 2014($) | | Increase |

Mr. Walker | | | | 1,300,000 | | | | | 1,300,000 | | | | | 0% | |

Mr. Gwin | | | | 750,000 | | | | | 750,000 | | | | | 0% | |

Mr. Meloy | | | | 700,000 | | | | | 700,000 | | | | | 0% | |

Mr. Daniels | | | | 700,000 | | | | | 700,000 | | | | | 0% | |

Mr. Reeves | | | | 700,000 | | | | | 700,000 | | | | | 0% | |

Performance-Based Annual Cash Incentives (Bonuses)

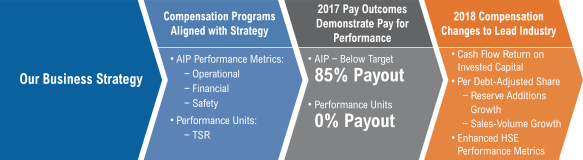

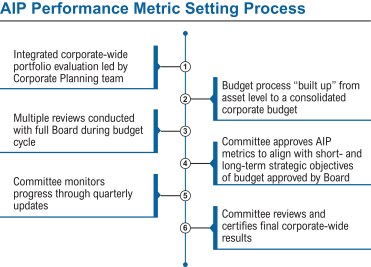

All employees of the Company, including our executive officers, participate in the Annual Incentive Program (AIP), which is part of our 2012 Omnibus Incentive Compensation Plan (2012 Omnibus Plan) that was approved by our stockholders in May 2012. Our AIP is designed to focus our executive officers and employees on the key drivers of the Company’s continued success and reward them for effectively managing the Company’s investment dollars in the safe and efficient growth of sales volumes, reserves and cash flows by focusing on the following performance criteria:

| | |

• Reserve Additions

| | • EBITDAX/BOE

|

• Sales Volumes

| | • Total Recordable Incident Rate

|

• Capital Expenditures

| | |

Capital expenditure and cash flow margin targets are incorporated in the incentive compensation program to incentivize financial discipline and cost management. These five metrics work together in order for the Company to achieve its long-term strategic performance objectives and provide the best, most direct means of aligning the actions of our executive officers and employees in the short term to position the company to deliver superior total stockholder returns over the long term.

In February 2014, the Committee established a baseline AIP performance hurdle for the NEOs of $3.1 billion of Cash Flow from Operating Activities (Net cash provided by (used in) operating activities) as calculated in the Consolidated Statements of Cash Flows, but excluding the effect of any significant (i.e., $100 million or greater) legal settlements/satisfaction of judgments (as described in Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Sources of Cash — Operating Activities) for the fiscal year as published in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014. If this performance hurdle was not achieved, the NEOs subject to Section 162(m) of the IRC would earn no

| | |

42

| |  |

Compensation Discussion and Analysis

AIP bonuses for the year under the 2012 Omnibus Plan. If the performance hurdle was met, the bonus pool would be funded at the maximum bonus opportunity level for each NEO. The Committee may apply negative discretion in determining actual awards, taking into consideration our actual performance against corporate annual performance goals, each individual officer’s performance and contributions, and other factors. The Committee does not have the discretion to increase bonuses above funded amounts. The AIP bonus pool was fully funded for the 2014 performance year because the Company exceeded the established performance hurdle.

If the initial performance hurdle is met, the Committee uses the following formula as a guideline for determining individual bonus payments:

| | | | | | | | | | | | | | | | | | | | | | | | | |

Individual base

salary earnings

for the year | | X | | Individual target

bonus opportunity

(equal to a

% of base salary) | | X | | AIP

performance

score % | | +/- | | Individual

performance

adjustments

(if any)

| | = | | Actual

bonus

earned

|

Individual Target Bonus Opportunities. Individual target bonus opportunities are set as a percentage of base salary. Executive officers may earn from 0% to 200% of their individual bonus target. The bonus targets for the NEOs for 2014 are shown in the table below. Following its annual review of executive compensation in November 2014, the Committee made no changes to the NEO bonus targets for 2015.

| | | | | | | | | | | | | | | |

Name | | Target Payout

as a % of Salary | | Minimum Payout

as a % of Salary

(i.e., 0% of

bonus target) | | Maximum Payout

as a % of Salary

(i.e., 200% of

bonus target) |

Mr. Walker | | | | 130% | | | | | 0% | | | | | 260% | |

Mr. Gwin | | | | 95% | | | | | 0% | | | | | 190% | |

Mr. Meloy | | | | 95% | | | | | 0% | | | | | 190% | |

Mr. Daniels | | | | 95% | | | | | 0% | | | | | 190% | |

Mr. Reeves | | | | 95% | | | | | 0% | | | | | 190% | |

| | | | |

| | | 43

| |

Compensation Discussion and Analysis

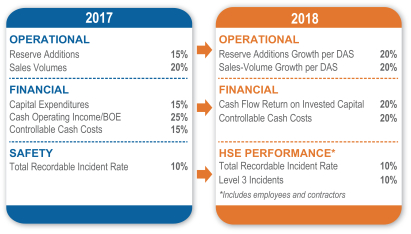

AIP Performance Goals and Score. The Company’s AIP performance score for 2014 was based on the achievement of targeted levels of performance for the following internal operational, financial and safety goals:

| | |

Performance Goals | | Purpose |

Operational:

• Reserve Additions

• Sales Volumes

| | The primary business objectives for an exploration and production company are to find reserves at a competitive cost while generating economic value for its stockholders and assuring that these reserves are prudently converted into production and cash flow. Including specific operational goals on reserve additions (excluding price revisions, acquisitions and divestitures) and sales volumes provides a direct line of sight for our employees and gives them a direct stake in our operational successes. |

Financial(1):

• Capital Expenditures

• EBITDAX/BOE

| | These financial goals focus on financial discipline and encourage employees to manage costs relative to gross margins and the commodity price environment. |

Safety:

• Total Recordable Incident Rate

| | The health and safety of our employees is very important to us and critical to our success. Accordingly, we include among our performance goals a target total recordable incident rate per 100 employees so that employees are focused on maintaining a safe work environment. |

(1) | For AIP purposes, Capital Expenditures excludes the capital expenditures of WES and WGP, expenditures for acquisitions, non-cash investments, and certain other expenditures including capital associated with assets expected to be divested and capital that is carried or subsequently reimbursed by another party. EBITDAX/BOE is calculated as earnings before interest, taxes, depreciation, depletion, amortization, and exploration expenses divided by sales volumes for the year. For AIP purposes, it excludes hedging arrangements, gains/losses on sales of assets, major legal-related settlements or expenses and other non-operating income/expense items. |

In early 2014, the Committee approved specified performance goals and target performance levels that were aligned with the Company’s capital budget at the time. The AIP performance goals were approved by the Committee with the qualification that certain modifications might be required during the course of the year as a result of any material developments related to (i) the Tronox Adversary Proceeding and/or (ii) additional clarity relating to the timing of the Mozambique development project. The outcome of both of these issues was largely beyond the direct control of the Company’s management.

In May 2014, following settlement of the Tronox Adversary Proceeding, the Board increased the Company’s capital budget as a result of reduced uncertainty regarding the financial impact of that matter. At the same time, despite substantial efforts by the Company and due principally to circumstances beyond the Company’s control, it became apparent that the reserves related to the Mozambique development project (which were included in the initial Reserve Additions performance goal) would not be booked in 2014, making the original targeted performance level no longer relevant. As a result of these two events, the Committee approved the following modifications to the targeted performance goals: an increase in Capital Expenditures from $8,400 MM to $8,900 MM and an increase in Sales Volumes from 295 MMBOE to 298 MMBOE to align with the new capital budget; and a decrease in Reserve Additions from 550 MMBOE to 492 MMBOE reflecting an increase in Reserve

| | |

44

| |  |

Compensation Discussion and Analysis

Additions associated with the increase to the capital budget and adjusted to reflect the reserves associated with the Mozambique development project. The Committee determined that these modifications were necessary in order to align the program with the revised direction and goals of the Company for 2014 and properly incentivize all employees.

Following these modifications, the 2014 AIP operational performance goals remained more challenging than the prior years’s goals. Over the last several years the Committee has established increasingly challenging annual performance goals under our AIP to generate competitive returns and advance our longer-term growth objectives, without compromising the safety of our employees. The Committee believes that the targets established for all of the 2014 AIP performance goals were challenging and appropriately required the executive officers and all employees to strive for strong performance on key metrics that ultimately result in long-term stockholder value creation.

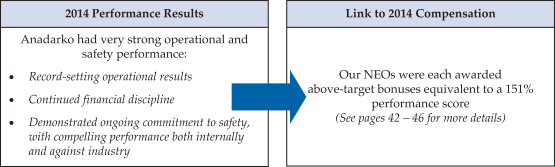

For 2014, the Company outperformed the goals relating to Reserve Additions, Sales Volumes and Safety performance with record-setting operational results and a continued commitment to safety. The Company also outperformed the targeted financial goals established by the Committee for Capital Expenditures and EBITDAX/BOE, which demonstrates our continued commitment to financial discipline by spending efficiently and maximizing margins.

2014 Performance Results. The table below reflects the 2014 performance results against each of the specified targets. Each performance goal is capped at 275% and the total AIP score cannot exceed 200%.

| | | | | | | | | | | | | | |

2014 AIP Performance Goals | | Relative

Weighting Factor | | AIP Target

Performance | | AIP

Performance

Results(1) | | AIP

Performance

Score(1) |

Reserve Additions (before price revisions and divestitures), MMBOE | | 25% | | | | 492 | | | | | 503.0 | | | 35% |

Sales Volumes, MMBOE | | 25% | | | | 298 | | | | | 307.4 | | | 51% |

Capital Expenditures, $MM | | 20% | | | | 8,900 | | | | | 8,585 | | | 25% |

EBITDAX/BOE($) | | 20% | | | | 31.60 | | | | | 34.61 | | | 25% |

Total Recordable Incident Rate (Safety) | | 10% | | | | 0.35 | | | | | 0.30 | | | 15% |

| | | | | | | | | | | | | | |

Total | | 100% | | | | | | | | | | | | 151% |

(1) | The Committee did not make any adjustments to the measured 2014 AIP performance results or overall calculated 2014 AIP performance score. |

Individual Performance Adjustments. The Committee may make an adjustment to an executive officer’s bonus payment based on individual performance to recognize an individual’s significant contributions that may not be reflected in the overall AIP performance score. Such adjustment cannot result in a bonus payment that exceeds the maximum bonus opportunity funded for each NEO by the achievement of the prescribed IRC Section 162(m) performance hurdle. The Committee did not make individual performance adjustments for any NEO’s 2014 bonus payments in recognition of the team effort necessary to drive the Company’s success.

| | | | |

| | | 45

| |

Compensation Discussion and Analysis

Actual Bonuses Earned for 2014. The AIP awards for 2014 for the NEOs are shown in the table below and are reflected in the “Non-Equity Incentive Plan Compensation” column of the Summary Compensation Table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Base

Salary

Earnings

for 2014($) | | | | Target Bonus

as % of Base

Salary | | | | AIP

Performance

Score | | | | Individual

Performance

Adjustments | | | | Actual

Bonus

Award

($) |

Mr. Walker | | | | 1,300,000 | | | X | | | | 130% | | | X | | | | 151% | | | + | | | | 0 | | | = | | | | 2,551,900 | |

Mr. Gwin | | | | 750,000 | | | X | | | | 95% | | | X | | | | 151% | | | + | | | | 0 | | | = | | | | 1,075,875 | |

Mr. Meloy | | | | 700,000 | | | X | | | | 95% | | | X | | | | 151% | | | + | | | | 0 | | | = | | | | 1,004,150 | |

Mr. Daniels | | | | 700,000 | | | X | | | | 95% | | | X | | | | 151% | | | + | | | | 0 | | | = | | | | 1,004,150 | |

Mr. Reeves | | | | 700,000 | | | X | | | | 95% | | | X | | | | 151% | | | + | | | | 0 | | | = | | | | 1,004,150 | |

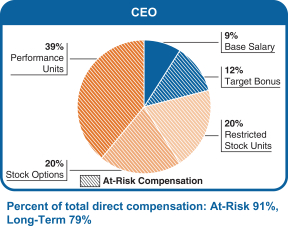

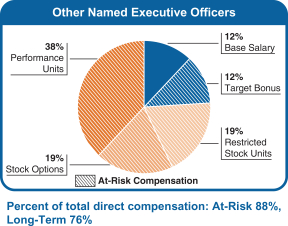

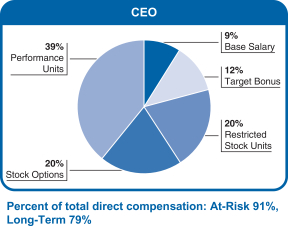

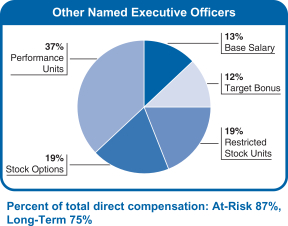

Equity Compensation

Our equity-based long-term incentive program is designed to reward our executive officers for sustained long-term share performance. This program represents 75% or more of target total compensation opportunity and includes a combination of equity-based awards (performance units, stock options and restricted stock units) that we believe are performance-based in absolute and relative terms. Pursuant to our equity grant administration procedures established by the Committee, annual equity-based awards for executive officers are typically made at the regularly scheduled Committee meeting in November. Equity awards for newly hired executive officers or awards made in connection with promotions are made on the date such awards are approved by the Committee.

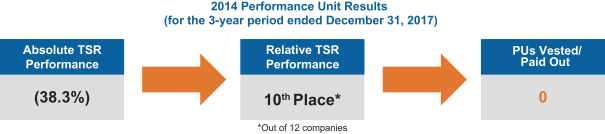

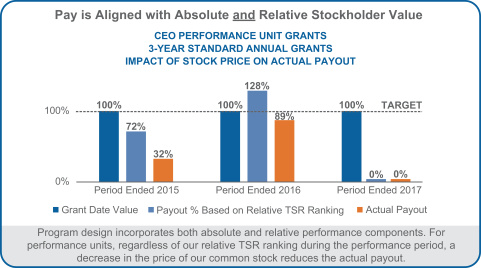

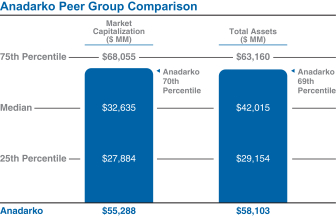

Changes to Equity Compensation Program in 2014. Our annual awards are determined based on a targeted dollar value. After receiving feedback from our stockholders that the majority of equity compensation granted to executive officers should be more performance-based, the Committee increased the amount of performance units so that the 2014 targeted equity award value was allocated 50% in performance units (from 40% in 2013 and 25% in 2012), 25% in non-qualified stock options (from 35% in 2013), and 25% in restricted stock units. The Committee believes that this allocation provides a combination of equity-based awards that is performance-based in relative and absolute terms, while also providing a retentive element that is necessary in an industry where there is increasing competition for executive talent. The Committee also eliminated our two-year performance unit program so that all performance unit awards granted in 2014 are subject to a three-year performance period. In addition, the Committee reduced the TSR performance payout opportunity for all new performance unit awards. For additional details on the terms of these awards see page 61.

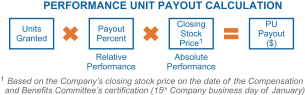

Performance Units. The Committee has established TSR as the performance criterion for the Company’s performance unit awards, and believes that a single focus on TSR as the performance criterion for the performance units is appropriate at this time and is consistent with most energy industry peers. TSR provides an effective relative comparison of our performance against an industry peer group. The Committee has discussed the extent to which certain operational or financial measures could be used as relative long-term performance criteria, such as return on capital employed. The Committee concluded that the performance measures included in our AIP are intended to capture the key drivers of the Company’s business, and that such AIP metrics should drive TSR performance over time. However, the Committee will continue to consider whether to include additional performance metrics in the performance unit program.

| | |

46

| |  |

Compensation Discussion and Analysis

Performance Unit Peer Group. The industry peer group for our awards granted in 2014 is listed below:

| | | | |

• Apache Corporation | | • EOG Resources, Inc. | | • Noble Energy, Inc. |

• Chevron Corporation | | • Hess Corporation | | • Occidental Petroleum Corporation |

• ConocoPhillips | | • Marathon Oil Corporation | | • Pioneer Natural Resources Company |

• Devon Energy Corporation | | • Murphy Oil Company | | |

If any of these peer companies undergoes a change in corporate capitalization or a corporate transaction (including, but not limited to, a going-private transaction, bankruptcy, liquidation, merger or consolidation) during the performance period, the Committee shall undertake an evaluation to determine whether such peer company will be replaced. At the time these awards were granted, the Committee pre-approved Chesapeake Energy Corporation and Talisman Energy as replacement companies (in that order).

Performance Unit Payout Opportunity. In November 2014, the Committee reduced the payout opportunity for achievement of TSR performance at the 55th percentile from a payout of 110% to a payout of 100% and reduced the payout opportunities for achievement of all applicable TSR performance levels in the third quartile by 12% to 14% (as reflected in the shaded areas in the table below) for all new awards. While certain stockholders suggested eliminating the payout opportunity for TSR performance below median, the Committee believes that completely eliminating any opportunity would place the Company at a competitive disadvantage in attracting and retaining executive talent because all of the companies in the industry peer group provide for some level of payout below median. The Committee also considered placing a cap on earned awards at target if absolute TSR is negative for the performance period, regardless of relative TSR. Our business is highly dependent on the prices we receive for our oil, natural gas and natural gas liquids, and the Committee believes that stockholders are best served by a management team that is highly incentivized to deliver differentiating performance in a challenging industry-wide environment. Accordingly, the Committee determined that placing such a cap on earned awards is not appropriate at this time. In addition, the Committee maintains the ability to apply negative discretion to these awards should the Committee deem such discretionary adjustment necessary.

The following table reflects the payout scale for the annual performance unit program for awards granted in November 2014 as well as outstanding performance unit awards granted prior to November 2014:

| | | | | | | | | | | | | | | | | | | | | | | | |

Final TSR Ranking | | 1 | | 2 | | 3 | | 4 | | 5 | | 6 | | 7 | | 8 | | 9 | | 10 | | 11 | | 12 |

TSR Performance Percentile | | 100% | | 91% | | 82% | | 73% | | 64% | | 55% | | 46% | | 36% | | 27% | | 18% | | 9% | | 0% |

| | | Payout as % of Target |

Awards Granted in November 2014 | | 200% | | 182% | | 164% | | 146% | | 128% | | 100% | | 80% | | 60% | | 40% | | 0% | | 0% | | 0% |

Awards Granted Prior to November 2014 | | 200% | | 182% | | 164% | | 146% | | 128% | | 110% | | 92% | | 72% | | 54% | | 0% | | 0% | | 0% |

| | | | |

| | | 47

| |

Compensation Discussion and Analysis

The examples below illustrate how the performance unit payout scale works under two different TSR ranking outcomes, assuming an executive officer received a target award of 20,000 performance units in November 2014 subject to a three-year performance period. Each performance unit earned is a right to receive a cash payment equal to the closing price of one share of our common stock on the date the Committee certifies the performance results for the performance period.

| | | | | | |

| | Relative TSR

Ranking for

Three-Year

Performance

Period | | Payout

Percentage | | Number of

Performance

Units Earned |

Example 1 | | 3rd | | 164% | | 32,800 units

(20,000 x 164%) |

Example 2 | | 10th | | 0% | | 0 units

(20,000 x 0%)

|

Stock Options. Stock options typically vest pro-rata annually over three years, beginning with the first anniversary of the date of grant, and have a term of seven years. The exercise price is not less than the market price on the date of grant and repricing of stock options to a lower exercise price is prohibited, unless approved by stockholders.

Restricted Stock Units. The Committee establishes objective performance criteria for each calendar year that must be achieved before any restricted stock units are awarded to executive officers the following year. If the performance criteria are achieved, the Committee may make awards of restricted stock units to the executive officers. The restricted stock units awarded vest pro-rata annually over three years, beginning with the first anniversary of the grant date. All of the restricted stock unit awards made in November 2014 were made after the Company’s achievement of the 2013 performance criterion, which was to obtain at least $3.1 billion in Cash Flows from Operating Activities (Net cash provided by (used in) operating activities) as presented in the Consolidated Statements of Cash Flows in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013.

Equity Awards Made During 2014

On November 6, 2014, the Committee approved the following awards under our 2012 Omnibus Plan for the NEOs. The target grant value of each of the awards was held flat as compared to awards granted in 2013. These awards, as well as a description of the methodology for calculating the grant date fair value, are included in the Grants of Plan-Based Awards Table on page 62.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Total LTI

Grant

Date

Value($) | | Performance

Units (50%) | | Stock

Options (25%) | | Restricted Stock

Units (25%) |

Name | | | Target #

of Units | | Grant Date

Value($) | | # of Stock

Options | | Grant Date

Value($) | | # of

Units | | Grant Date

Value($) |

Mr. Walker | | | | 11,097,530 | | | | | 55,606 | | | | | 5,557,820 | | | | | 118,005 | | | | | 2,779,856 | | | | | 29,514 | | | | | 2,759,854 | |

Mr. Gwin | | | | 4,430,129 | | | | | 22,198 | | | | | 2,218,690 | | | | | 47,107 | | | | | 1,109,704 | | | | | 11,782 | | | | | 1,101,735 | |

Mr. Meloy | | | | 4,530,919 | | | | | 22,703 | | | | | 2,269,165 | | | | | 48,179 | | | | | 1,134,958 | | | | | 12,050 | | | | | 1,126,796 | |

Mr. Daniels | | | | 4,530,919 | | | | | 22,703 | | | | | 2,269,165 | | | | | 48,179 | | | | | 1,134,958 | | | | | 12,050 | | | | | 1,126,796 | |

Mr. Reeves | | | | 3,467,795 | | | | | 17,376 | | | | | 1,736,731 | | | | | 36,873 | | | | | 868,621 | | | | | 9,223 | | | | | 862,443 | |

| | |

48

| |  |

Compensation Discussion and Analysis

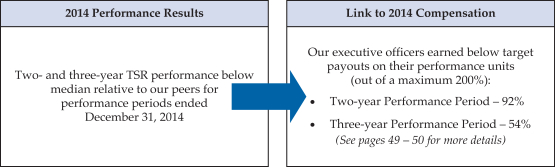

Performance Units — Results for Performance Periods Ended December 31, 2014

In January 2015, the Committee certified the performance results for the 2011 and 2012 annual performance unit awards for the three- and two-year performance periods, respectively, that ended December 31, 2014. Under the provisions of these awards, the targeted performance units were subject to our relative TSR performance against the defined TSR peer group discussed on page 47. However, Plains Exploration & Production Company, which was included in the TSR peer group at the time the awards were granted, was acquired in May 2013 and the Committee replaced it with Murphy Oil Company. TSR performance is based on the difference between (1) the average closing stock price for the 30 trading days preceding the beginning of the performance period, and (2) the average closing stock price for the last 30 trading days of the performance period, plus dividends paid for the performance period, and further adjusted for any other distributions or stock splits, where applicable.

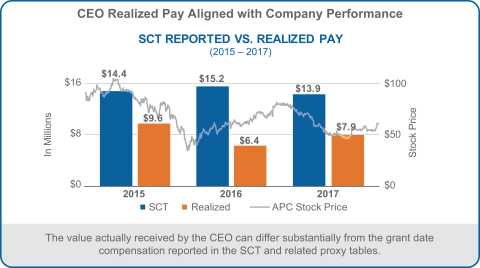

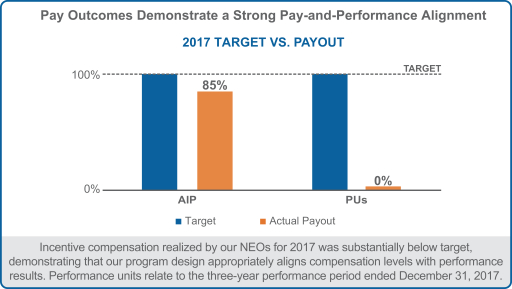

The Committee believes that these below-target payouts for below-median performance demonstrate that our performance unit program, and our overall executive compensation program, is well-designed to link pay and performance. This year’s payouts show that the values actually earned by executives under our executive compensation program can differ substantially from the grant date values required to be reported in the Summary Compensation Table and other proxy tables, as our program is designed to pay out at levels aligned with actual performance.

For the performance periods ended December 31, 2014, the performance results and Anadarko’s ranking, as highlighted, were as follows:

2011 Annual Award — Three-Year Performance Period (January 1, 2012 to December 31, 2014)

| | | | | | | | | | | | | | | | | | | | | | | | |

Final TSR Ranking | | 1 | | 2 | | 3 | | 4 | | 5 | | 6 | | 7 | | 8 | | APC

9 | | 10 | | 11 | | 12 |

TSR | | 90.4% | | 69.3% | | 43.1% | | 34.5% | | 20.7% | | 18.8% | | 13.8% | | 10.8% | | 9.8% | | 0.0% | | -1.9% | | -28.0% |

Payout as % of Target | | 200% | | 182% | | 164% | | 146% | | 128% | | 110% | | 92% | | 72% | | 54% | | 0% | | 0% | | 0% |

|

2012 Annual Award — Two-Year Performance Period (January 1, 2013 to December 31, 2014) |

Final TSR Ranking | | 1 | | 2 | | 3 | | 4 | | 5 | | 6 | | APC

7 | | 8 | | 9 | | 10 | | 11 | | 12 |

TSR | | 56.5% | | 50.1% | | 42.3% | | 29.1% | | 17.6% | | 17.1% | | 12.9% | | 11.9% | | 3.5% | | 3.2% | | -0.6% | | -14.7% |

Payout as % of Target | | 200% | | 182% | | 164% | | 146% | | 128% | | 110% | | 92% | | 72% | | 54% | | 0% | | 0% | | 0% |

| | | | |

| | | 49

| |

Compensation Discussion and Analysis

The following table lists the number of performance units awarded at minimum, target, and maximum levels and the actual number of performance units earned by the NEOs for the 2011 and 2012 annual performance unit awards for the three-year and two-year performance periods that ended December 31, 2014:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2011 Annual Performance Unit Award | | | | 2012 Annual Performance Unit Award |

Name | | Minimum

# Units | | Target

# Units | | Maximum

# Units | | Actual #

Units

Earned | | | | Minimum

# Units | | Target

# Units | | Maximum

# Units | | Actual #

Units

Earned |

Mr. Walker | | | | 0 | | | | | 8,178 | | | | | 16,356 | | | | | 4,416 | | | | | | | 0 | | | | | 17,167 | | | | | 34,334 | | | | | 15,794 | |

Mr. Gwin | | | | 0 | | | | | 4,903 | | | | | 9,806 | | | | | 2,648 | | | | | | | 0 | | | | | 6,119 | | | | | 12,238 | | | | | 5,629 | |

Mr. Meloy | | | | 0 | | | | | 5,033 | | | | | 10,066 | | | | | 2,718 | | | | | | | 0 | | | | | 6,281 | | | | | 12,562 | | | | | 5,779 | |

Mr. Daniels | | | | 0 | | | | | 5,033 | | | | | 10,066 | | | | | 2,718 | | | | | | | 0 | | | | | 6,281 | | | | | 12,562 | | | | | 5,779 | |

Mr. Reeves | | | | 0 | | | | | 3,838 | | | | | 7,676 | | | | | 2,073 | | | | | | | 0 | | | | | 4,789 | | | | | 9,578 | | | | | 4,406 | |

Performance Units — Results for 2012 CEO Appointment Award

In connection with his appointment to CEO on May 15, 2012, Mr. Walker received a promotional equity award, including performance units (2012 CEO Appointment Award). The performance units were subject to the same performance criteria as performance unit awards for executive officers, except that the two- and three-year performance periods for the grant to Mr. Walker begin on May 15, 2012 and end on May 14, 2014 and May 14, 2015, respectively. In June 2014, the Committee certified the performance results for the two-year performance period that ended May 14, 2014. For such performance period, the performance result and Anadarko’s ranking, as highlighted, was as follows:

2012 CEO Appointment Award — Two-Year Performance Period (May 15, 2012 to May 14, 2014)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Final TSR Ranking | | 1 | | 2 | | 3 | | 4 | | 5 | | 6 | | APC

7 | | 8 | | 9 | | 10 | | 11 | | 12 |

TSR | | 91.1% | | 81.3% | | 64.6% | | 53.4% | | 46.0% | | 43.5% | | 36.9% | | 28.6% | | 25.4% | | 12.5% | | 5.9% | | -5.4% |

Payout as % of Target | | 200% | | 182% | | 164% | | 146% | | 128% | | 110% | | 92% | | 72% | | 54% | | 0% | | 0% | | 0% |

The following table lists the number of performance units awarded at minimum, target, and maximum levels and the actual number of performance units earned by Mr. Walker for the two-year performance period that ended May 14, 2014:

| | | | | | | | | | | | | | | | | | | | |

| | | 2012 CEO Appointment Award |

Name | | Minimum

# Units | | Target

# Units | | Maximum

# Units | | Actual #

Units

Earned |

Mr. Walker | | | | 0 | | | | | 5,253 | | | | | 10,506 | | | | | 4,833 | |

| | |

50

| |  |

Compensation Discussion and Analysis

Indirect Compensation ElementsINDIRECT COMPENSATION ELEMENTS

As identified in the table below, the Company provides certain benefits and perquisites (considered indirect compensation elements) that are considered typical within our industry and necessary to attract and retain executive talent. The value of each element of indirect compensation is generally structured to be competitive within our industry.

| | | | |

Indirect Compensation

Element | | | | Primary Purpose |

Retirement Benefits | | • •

| | Attracts talented executive officers and rewards them for extended service • Offers secure andtax-advantaged vehicles for executive officers to save effectively for retirement |

Other Benefits (for example, health care, paid time off, disability and life insurance) and Perquisites | | • •

| | Enhances executive welfare and financial security • Provides a competitive package to attract and retain executive talent, but does not constitute a significant part of an executive officer’s compensation |

Severance Benefits | | • •

| | Attracts and helps retain executives in a volatile and consolidating industry • Provides transitional income following an executive’s involuntary termination of employment |

Retirement Benefits

Our executive officers participate in the following retirement and related plans:

Anadarko Employee Savings Plans. The Anadarko Employee Savings Plan (401(k) Plan) is atax-qualified retirement savings plan that allows participating U.S. employees to contribute up to 30% of eligible compensation, on abefore-tax basis or on anafter-tax basis (via a Roth or traditionalafter-tax contribution), into their 401(k) Plan accounts. Eligible compensation includes base salary and AIP bonus payments. Under the 401(k) Plan, we match an amount equal to one dollar for each dollar contributed by participants up to six percent of their total eligible compensation. In addition, participants in the Personal Wealth Account (PWA) program, a qualified pension plan, receive an additional four percent contribution of eligible compensation. The 401(k) Plan is subject to applicable IRC limitations regarding participant and Company contributions. Due to IRC limitations that restrict the amount of benefits payable undertax-qualified plans, we also sponsor anon-qualified Savings Restoration Plan. The Savings Restoration Plan accrues a benefit equal to the excess, if any, of Company matching and Personal Wealth Account (PWA)PWA contributions that would have been allocated to a participant’s 401(k) Plan account each year without regard to the IRC limitation over amounts that were, in fact, allocated to a participant’s account. For additional details on the Savings Restoration Plan see page 69.61. Amounts deferred, if any, under the 401(k) Plan and the Savings Restoration Plan (collectively, the Savings Plans) by the NEOs are included, respectively, in the “Salary” and “Non-Equity“Non-Equity Incentive Plan Compensation” columns of the Summary Compensation Table.Table on page 53. Our matching contributions allocated to the NEOs under the Savings Plans are included in the “All

Other Compensation” column of the Summary Compensation Table.

| | | | |

| | | 51

| |

Compensation Discussion and Analysis

Pension Plans. Anadarko provides funded,tax-qualified retirement benefits for all U.S. employees. Due to IRC limitations that restrict the amount of benefits payable undertax-qualified plans, we also sponsornon-qualified restoration plans that cover the executive officers and certain other employees. The pension plans do not require contributions by participants and a participant becomes vested in his or her benefit at the completion of three years of service as defined in the pension plans. Eligible compensation covered by the pension plans includesconsists of base salary and AIP bonus payments.

Messrs. Walker and Reeves each have supplemental retirement benefits under ournon-qualified Retirement Restoration Plan that provide for special service credits of eight years and five years, respectively, if they each remain employed by us until the age of 55. Messrs. Walker and Reeves vested in these benefits in 2012. The service credits are considered applicable service towards our retirement benefit programs, including pension and retiree medical and dental benefits, where applicable. These supplemental retirement benefits were provided to Messrs. Walker and Reeves in 2007 to recognize that they weremid-career hires that we would like to retain for the remainder of their careers. Providing them additional service credits recognizes a portion of their prior industry experience and service years which directly benefit us and our stockholders. Mr. Meloy is eligible to receive supplemental pension benefits under the terms of his retention agreement, which was entered into in August 2006 in connection with the closing of the Kerr-McGee acquisition (2006 Retention Agreement).

The accrued benefits for each of the NEOs, including the benefits related to any special service credits are discussed in the Pension Benefits Table on page 69.61. The Committee

| | | | |

| | | 47 | |